Property Taxes in Mexico are typically very low compared to most parts of Canada and the United States. The tax amount for each year is available after the 7th of January each year. You can check your property taxes online by entering your clave catastral (tax ID number). You will find this number written on the deed to your property, usually where the property description is. You can also receive a statement of your account via WhatsApp +52 624 315 1516 by providing your clave catastral

Property taxes can be paid through January for a 20% discount, February is a 15% discount, March up to a 10% discount and 5% discount in April. They can also be paid every two months if you cannot pay for the entire year at one time. In this case, using the online system, you change the two-month period you wish to consult by changing the number to 1 for one two-month period or 2 for the four-month period or 3 for six months period and so on. Payments in increments do not receive the tax discounts.

Even though the property taxes in Mexico are inexpensive, the penalties for nonpayment or late payment are high. You will receive a penalty by percentage, but be aware that the penalty will also compound, not just annually but daily for each delinquent year. If you have never paid your property taxes or are delinquent for many years the city can place a lien on your property. They will try to contact you by the address on record on your Fideicomiso. If contact is not made by that avenue, they may deliver notice to the homeowners’ association (if you have one) for your property here in Mexico. If they cannot reach you or you do not respond, the lien will remain for a time period, and the property will be put up for auction based on current laws. This is common practice in many countries, but not a frequent occurrence. However, it is legal.

Keep in mind that with billing in Mexico, it is the responsibility of the property owner to be diligent in remembering to pay and when. Property tax bills are not mailed or sent out electronically.

So pay your property taxes and keep them current.

The Municipality offers different ways to pay your taxes:

A. Going to one of the three different offices open to the public

B. Going to the Banamex or Bancomer Bank branches in Mexico, or paying online with charge to your credit card; Check the following steps.

Easy Seven Steps for Credit Card Payments

STEP 1 – THE LINK

Click on the following link: https://www.tesoreria.loscabos.gob.mx/pagos-y-consultas/

STEP 2 – CLICK ON THE BOX TO THE RIGHT

CONSULTA (to find and confirm the amount to pay)

STEP 3 – TO PAY ONLINE GO BACK TO THE HOME PAGE

CLICK ON THE 2ND BOX ON THE RIGHT

PAGAR (pay on line)

ESTADO de cuenta (statement of account) # clave catastral

Input your tax ID number and click on BUSCAR

Your tax account will pop up and a large green box asking if you want a receipt with fiscal data. This is if you are a person in Mexico with a registered tax ID (RFC) number and need a fiscal receipt to claim on your Mexican taxes as a business or a fiscal person earning income in Mexico.

PROPERTY TAX NUMBER

Type in the property tax number without hyphens (clave catastral) where it says “INTRODUZCA CLAVE”. If you are not sure of the property tax number, please ask your Property manager or look at your title documents where the property description is. Then click on the red button “BUSCAR”.

STEP 4 – READ IT AND CONFIRM

Your statement should come up. Take a minute to read it and confirm It is under your name and the amount to pay is correct.

PAGAR EN LINEA / PAY ONLINE click here at the bottom of the page

STEP 5 – PAYMENT

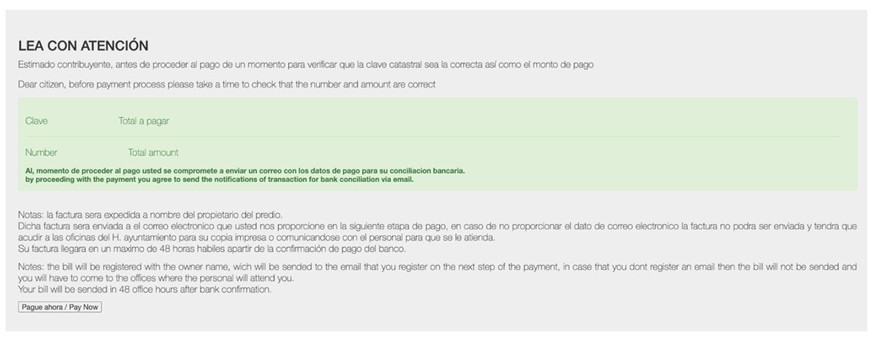

READ WITH ATTENTION

Notes: the bill will be registered with the owners name, which will be sent to the email that you register on the next step of the payment, in case that you don’t register an email address, then the bill will not be sent and you will have to come to the offices where the person will attend you.

Your bill will be sent in 48 office hours after bank confirmation

Please confirm your tax code is correct and the amount you will pay. At the end of the page you will see a “Pague ahora / Pay now” grey button, click on it.

STEP 6 – PAYMENT INFORMATION

On the next page you will need to fill in the following information:

CORREO ELECTRONICO complete your email address and double check for spelling mistakes

NUMBERO DE TELEFONO A 10 DIGITOS add your telephone number area code and number (do not add hyphens the system will add the number in two digit increments)

CLICK ON THE GREY BUTTON THAT SAYS “Continuar”

NOMBRE DE TITULAR: credit card holder name

NUMERO DE TARJETA: 16 digit credit card number

VIGENCIA (mes/ ano): card expiration date

CODIGO DE SEGURIDAD CVV2: 3 digit number on the back of your card

CLICK ON THE GREY BUTTON: Continuar

NOTE – if a blank page appears your computer may be blocking pop-ups – go to ‘Settings’ and allow Pop-ups.

If your credit card is declined, check the number, available limit, expiration date or contact your bank.

STEP 7 – CONFIRM AND SAVE

You will receive your electronic payment confirmation to the email address you previously provided.

https://www.tesoreria.loscabos.gob.mx/ Now receive and inquire about your Mexico property tax on WhatsApp +52 315 1516

Bienvenido a Tesorería Municipal del H. XV Ayuntamiento de los Cabos Ingresa el número de tema que deseas consultar

1. DERECHO SANEAMIENTO AMBIENTAL

Asesoría y Soporte Técnico en la ejecución de la Plataforma. Seguimiento a Generación de boleta, Pagos y liberación.

INGRESA: Nombre de la Empresa y RFC

2. IMPUESTO PREDIAL

Estado de Cuenta predial, aclaraciones PAGO EN LINEA, seguimiento a métodos de pago.

INGRESA: clave predial y nombre de propietario.

3. OTRO

Welcome to the Municipal Treasury of the H. 15 Los Cabos City Council

Enter the topic number you wish to consult

4. ENVIRONMENTAL SANITATION LAW.

Advice and Technical Support for Platform Implementation. Follow-up on invoice generation, payments, and release.

ENTER

Company Name and RFC

PROPERTY TAX

Property tax account statement, ONLINE PAYMENT clarifications, payment method follow-up.

ENTER

Property tax code and owner name.

OTHER.