Property Taxes in Mexico typically are very low compared to most parts of Canada and the United States. The tax amount for each year is available after the 7th of January each year. You can check your property taxes on line by entering your clave catastral (tax ID number), make sure to include any hyphens exactly as it appears on your last statement or in your trust or escritura. You will find this number written on the deed to your property usually where the property description is. You can also receive a statement of your account via Whatsapp +52 624 315 1516 by providing your clave catastral.

Property taxes can be paid through January for a 20% discount, February is a 15% discount, March up to 10% discount and 5% discount in April. They can also be paid every two months if you cannot pay for the entire year at one time. In this case, using the online system you change the two months period you wish to consult by changing the number to 1 for one two month period or 2 for the four month period or 3 for six months period and so on. Payments in increments do not receive the tax discounts.

Even though the property taxes in Mexico are inexpensive the penalties for non payment or late payment are high. You will receive a penalty by percentage but be aware that the penalty will also compound, not just annually but daily for each delinquent year. If you have never paid your property taxes or are delinquent for many years the city can place a lien on your property. They will try to contact you by the address on record on your Fideicomiso. If contact is not made by that avenue they may deliver notice to the home owners association (if you have one) for your property here in Mexico. If they cannot reach you or you do not respond the lien will remain for a time period and the property will be put up for auction. This is common practice in many countries, but not a frequent occurrence. However it is a legal process.

Keep in mind with billing in Mexico it is the responsibility of the property owner to be diligent in remembering to pay and when. Property tax bills are not mailed or sent out electronically.

So pay your property taxes and keep them current.

The Municipality offers different ways to pay your taxes:

A. Going to one of the three different offices open to the public

B. Going to the Banamex or Bancomer Bank branches in Mexico, or paying online with charge to your credit card; Check the following steps.

Easy Seven Steps for Credit Card Payments

STEP 1 – THE LINK

Click on the following link: https://www.tesoreria.loscabos.gob.mx/pagos-y-consultas/

STEP 2 – SCROLL DOWN

Scroll down the page, until you find the below image. Select and on the back of your preference; Banamex or Bancomer

STEP 3 – PROPERTY TAX NUMBER

Type in the property tax number (clave catastral) where it says “INTRODUZCA CLAVE”. If you are not sure of the property tax number, please ask your Property manager or look at your title documents where the property description is. Then click on the red button “BUSCAR”.

STEP 4 – READ IT AND CONFIRM

Your statement should come up. Take a minute to read it and confirm It is under your name and the amount to pay is correct.

STEP 5 – PAYMENT

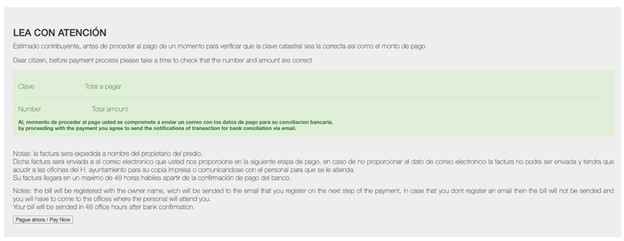

For payment, click on the ‘red icon’ which says “Pagar”, this means pay. Payment instructions in both English and Spanish should be here. You will see an image like this:

Please confirm your tax code is correct and the amount you will pay. At the end of the page you will see a “Pague ahora / Pay now” grey button, click on it.

STEP 6 – PAYMENT INFORMATION

On the next page you will need to fill in the following information in this order:

CREDIT CARD 16 DIGIT NUMBER

EXPIRATION DATE (month and year)

CREDIT CARD HOLDER NAME

SECURITY CODE (THE 3 DIGITS ON THE BACK OF YOUR CARD).

Add the address affiliated with your credit card and email address (CORREO ELECTRÓNICO).

NOTE – if a blank page appears your computer may be blocking pop-ups – go to ‘Settings’ and allow Pop-ups.

If your credit card is declined, check the number, available limit, expiration date or contact your bank.

STEP 7 – CONFIRM AND SAVE

Confirm payment and save or print your receipt – be sure it is under your name and is the correct amount.